Examining the role of KYC in money security perspective

KYC, which is the acronym for ‘KNOW YOUR CUSTOMER’ profile, organised and implemented by these financial institutions to cure the threats to their money standards. KYC is the genial process through which banks and other financial entities collect possessive information about their customers. This also includes the finding of the validation of their information by conducting the critical analyses. This ensures the secure monitoring over the public record databases. KYC or ‘Know Your customer’ is also used to evaluate the possible risk of illegal activities as this also acts as critical process to eliminate Anti-Money Laundering and Customer Due Diligence by administering regular checks.

CKYC- Improved version of KYC

Before CKYC, clients had to deposit their KYC separately to the financial entities in order to enrol for various activities, such as KYC for Mutual Funds, KYC for Bank Account, KYC for pension Scheme and KYC for Insurance. On the other hand, CKYC (Central Know Your Customer) if registered for once, a person can formulate his financial activities with different kinds of financial entities. This simply means one need not to deposit his KYC while making deals with any of the financial entity. This is why, CKYC has been introduced.

There are several other reasons CKYC is approved over traditional KYC, these are mentioned below

- It urges for onerous efforts as to feed the information and requires an encyclopaedic type mind labouring. Due to manual Data Entry, clients find it difficult and tend to make errors and waste on remediation cost for no reasons.

- It is high in cost as to fill it many times.

- It is time consuming and has inconsistency.

- It lacks in security and total wastage of human resource.

CannyCKYC- solution for the financial glitches

CannyCKYC is aggressively working in the move of conducting clients’ CKYC automation process which is leveraging by advanced AI and machine learning technologies. It provides the surety to the clients that make them highly dependent on your working progress in the direction of the safety of their money.

Although, automatic CKYC has reduced the legwork and work with maximum comprehensive Process Automation. The comprehensive or intelligent process Automation is comprised RPA, IDP and AI.

Benefits of CannyCKYC

- With CannyCKYC, financial entities or companies can regulate their clients upholding in minimum cost and increasing efficiency.

- It also minimise the risk and provides scalability.

- It can help them in improving customer satisfactory experience

- It demands less labour as there is no need for employees to perform the same task for multiple times.

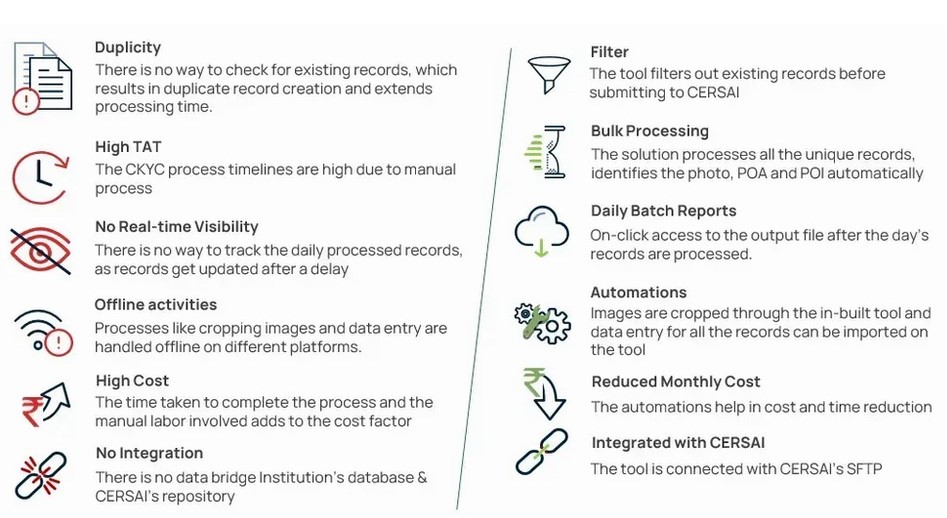

Current Challenges vs Our Solutions

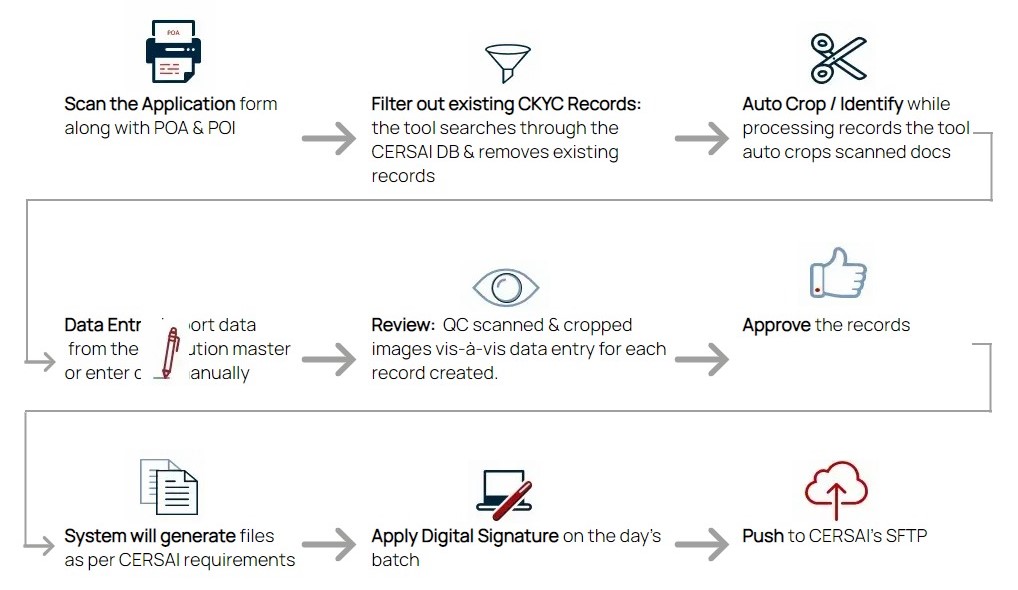

WorkFlow

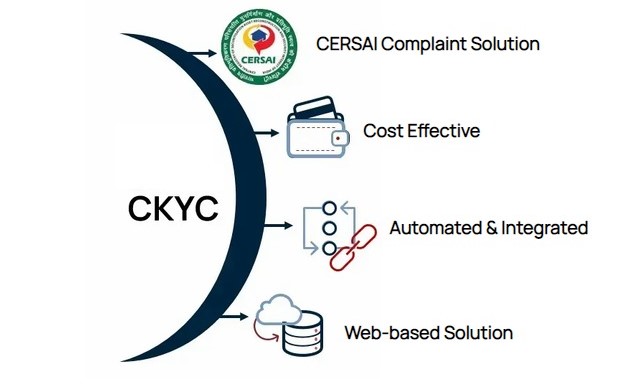

Features

CERSAI - Compliant Solution

Application has been built as per CERSAI’s guidelines, following the file type & dimensions for customer Photo, POI, POA and format for flat file

Automation & Integration

Application has semi-automated segments that require minimal manual efforts, thus reducing the TAT. Capable of integrating Financial Institution’s database with CERSAI database to maintain customer information & digital copies of POI & POA documents

De-Duplication

Application is capable of automatically screening records in Financial Institution’s database as well as CERSAI’s portal to identify duplicate/already existing customer records.

Web-Based Solution

Web-based application that can be accessed anytime anywhere; thus bringing all stakeholders on a common platform and promoting real-time monitoring

Scalable & Affordable Model

Application is a scalable model that can suit the growing needs of diverse financial entities. It is a cost effective solution that brings all parts of the CKYC process on a single platform

Conclusion

CannyMinds is possessive for the satisfaction of its clients and this move motivates it to work for several sectored institutions. With CannyCKYC, it is trying to improve the work efficiency and productivity of the financial institutions and relieving the customer from the possible threats.